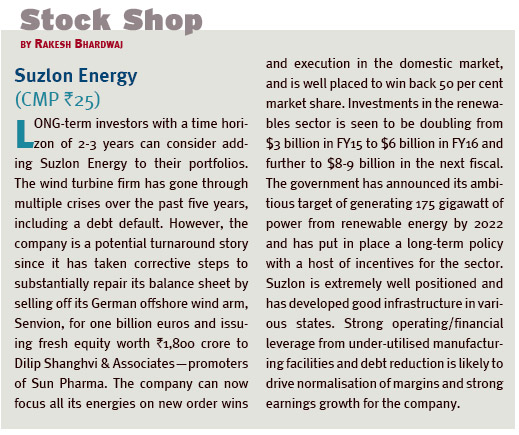

THE completion of one year of the Modi Government has left the market confused since the analysts I talked to had diametrically opposite views, ranging from extreme disappointment to happiness and optimism about the future. I would like to be in the latter camp and feel that under the given circumstances, the government has already achieved a lot regarding most of the low hanging reforms such as privatising coal and other mines, higher FDI in defence and insurance, quicker project clearances, deregulating diesel prices, raising natural gas prices, enhancing financial inclusion, more flexible labour markets, up to 100 per cent FDI in key areas besides achieving much in fiscal consolidation. It is only the big ticket reforms such as GST and land acquisition that remain worrisome. Even GST can best be described as a work in progress. It will be naïve to expect miracles from a government that has been fighting battles both within and outside.

What then, explains the selling by FIIs, leading to a 10 per cent fall in the market since mid-April? Is it a vote against the Modi Government or too much negativity surrounding prospects on economic growth, reforms and corporate earnings? To me, FII selling can best be described as repositioning/rebalancing of portfolio viz-a-viz other markets such as China. Moreover, FIIs have already heavily invested in India and retail investors through mutual funds have also been steadily investing since Modi came to power. Their appetite for further investment may be waning and until issues like MAT on foreign portfolio investment get resolved, the market may witness nervousness.

The global scenario may also cause volatility especially when the US Fed takes a decision to hike the rates or Greece defaults. Rising oil prices, capex cycle not picking up, muted corporate earnings, IIP index touching a low, rising bank NPAs, and corporate balance sheets remaining under pressure are some other worries the market faces today. Low inflation coupled with declining manufacturing index actually points to a deflation-like scenario. An errant monsoon may further add to the corporate sector woes as it may impact rural incomes. The market may, therefore, witness both price and time corrections. The investment scenario may remain muted for another couple of quarters post which the economic fundamentals will witness significant improvement.

The recent decline in the rupee may not all be bad news since the rupee has been overvalued for quite some time. The much-needed correction will, in fact, give a boost to the decline in exports. In the short run, therefore, IT and pharma may outperform the market.

Investors may do well to pick stocks with a time horizon of 2-3 years since there are not too many attractive investment destinations in the world and India on the whole is still one of the most attractive investment destinations compared to BRICS, the struggling Euro Zone or the East Asian nations hit by a trade slump.

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.